foreign gift tax india

Residents to a non-resident person are subjected to tax in India the Finance No. In case someone sends you money from India to the US as a gift or inheritance you might need to report it to the IRS as a foreign gift on Form 3520 this is done with your US tax return.

Cheap Non Currency Coins Buy Directly From China Suppliers Lot 100 Pcs Different World Banknotes From 30 Foreign Countr Big Coins Big Size Different Countries

Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than 100000 during the tax year.

. For original and belated returns Form 67 can now be filed on or before the end of the assessment year relevant to the tax year in which the relevant income was subject to tax. Prasid Banerjee 23 Aug 2022. 19 Aug 2022 0458 PM IST Livemint.

Foreign gift tax india Sunday April 24 2022 Edit. For example if you receive Rs 75000 as a gift from your friend the entire amount of Rs 75000 would be added to your income and taxed at your slab rate. In the current case the Indian parents are not US persons and are not liable for US tax.

Whether or not this is necessary depends largely on the value of the transfer ². Foreign gift tax. 16 rows Estate Gift Tax Treaties International US.

International platforms such as Binance and KuCoin. There was an ambiguity on taxability of gifts received outside India by NRIs. 11 hours agoPhoto Credit.

1 min read. In Example 1 if consideration is Rs 280000 taxable gift amount is Nil as stamp duty value does not exceed consideration by Rs 50000. Indias tax on cryptocurrency transactions is becoming a boon for international exchanges as users transact in overseas exchanges to avoid paying the 1 tax deduction at source TDS imposed in July.

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax Research Platform. International Tax Gap Series.

NRIs are taxable on gifts received in India or accruing or arising in India or deemed to accrue or arise in India. Gifts to Resident Indians from NRIs non-relative within INR 50000- are exempt from tax for both giver and receiver. The estate tax provisions are located in Article XXIX B of the United States Canada Income Tax Treaty.

1 Gifts up to Rs 50000 in a financial year are exempt from tax. When an nri gives gifts in the form of cash cheque items or property that exceeds the value of rs. The IRS defines a foreign gift is money or other property received by a US.

Tax on gifts in India falls under the purview of the Income Tax Act as there is no specific gift tax after the Gift Tax Act 1958 was repealed in 1998. The new tax is not applicable to inward remittances. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

While the individual providing the. The entire amount in cash received as a gift. All immovable property assets like land and building without any consideration.

Money received without any consideration. Stamp duty value that is more than Rs. As of october 1 2020 the reserve.

The Central Board of Direct Taxes CBDT has made changes to rule 128 under Income Tax Rules 1962 for FTC. 05-07-2019 by a person resident in India to a non-resident or a foreign company shall be deemed to accrue or arise in India. Gifts worth more than Rs.

If you are a US. This was the case previously. Accordingly Finance Act 2019 No.

As per the new provisions any sum of money received on or after July 5. Gifts up to rs 50000 per annum are exempt from tax in india and gifts from relatives like parents spouse and siblings are also exempt from tax. The pre-amended rule required.

2 introduced provisions to clarify this. The stamp duty of the property. As a US.

1 Gifts up to Rs 50000 in a financial year are exempt from tax. Visit the United States Income Tax Treaties - A to. 2 Act 2019 has inserted a new clause viii under Section 9 of the Income-tax Act to provide.

The person who receives the gift is known as the donee. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who received large gifts or bequests from a foreign person you may need to complete Part IV of Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign. Gifts of movable properties outside India unless the donor-.

Also gifts received outside India from foreign friends will not be taxable in India as Ayush is a Non-Resident. Cases in which sum of money received. Once the 100000 threshold has been surpassed the recipient must separately identify each giftinheritance that is more than 5000.

However if you receive gifts higher than this amount the entire gift becomes taxable. Above 15000 USD as gifts will trigger a tax event. You may be required to file Form 3520 to the IRS.

Approximately 135 percent of the current US. It would be considered Income from. The Central Board of Direct Taxes CBDT issued guidance regarding filing of Form 67 to claim a credit for foreign tax paid outside India on income also taxed in India.

Citizen the need to report cash gifts from foreign relatives depends on how much money you received.

Income Tax Section 80d Deduction In Respect Of Health Insurance Premium

India Diamond Mogul Gives 600 New Cars As Gifts To His Workers

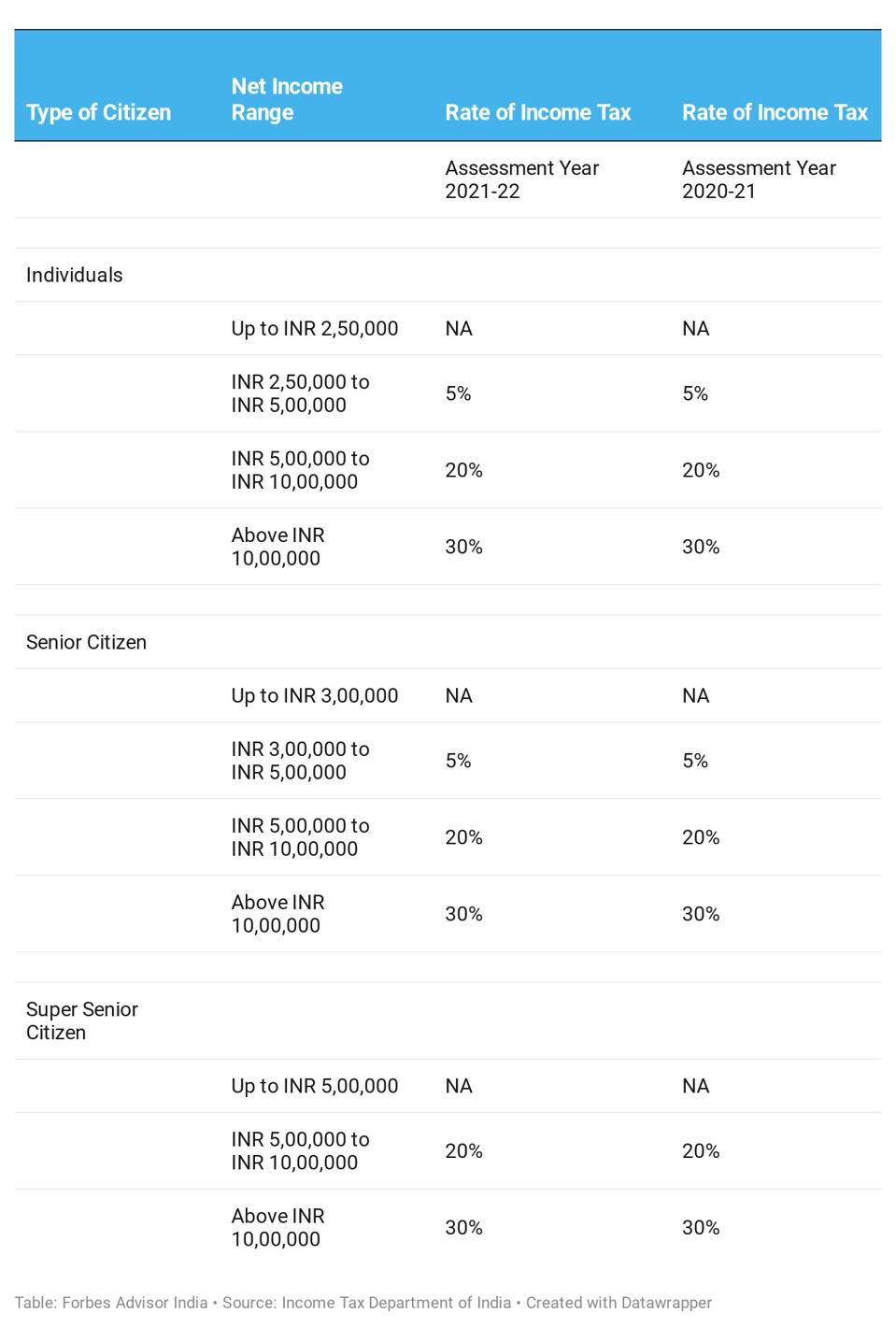

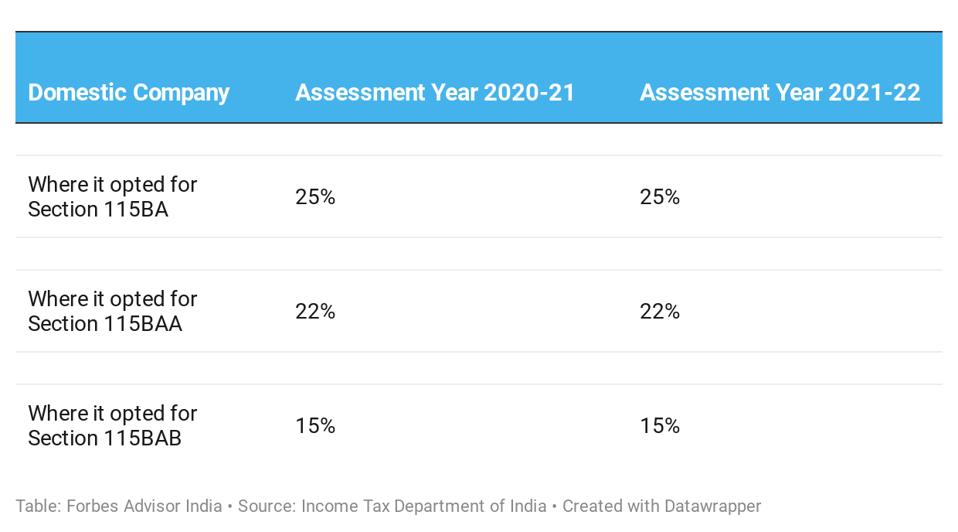

Know Types Of Direct Tax And Charges Forbes Advisor India

Yes Reserve Bank Has Granted General Permission To Foreign Citizens Of Indian Origin To Acquire Or Dispose Of Properties Up To The Originals Citizen Ahmedabad

Tax Rules For Nris On Sale Of Assets Located In India Mint

Eztax Services Screen In Ipad Filing Taxes Self Service Service

Non Resident Indian Nri Definition Under Fema Smart Paisa Finance Guide Resident Definitions

Tax Implications On Money Transferred From Abroad To India Extravelmoney

Know Types Of Direct Tax And Charges Forbes Advisor India

International Currencies Greeting Card For Sale By Russell Shively Currency Design Paper Currency Banknote Collection

Affidavit Of Ownership Of Birth Certificate Birth Certificate Certificate Read Online For Free

Taxation Of Gifts Received Here Are The Things You Need To Know Youtube

Cbdt Releases Faqs On Itr Filing To Assist Taxpayers Sag Infotech Income Tax Return Income Tax Return Filing Tax Return

What Are Tax Rules For Foreign Retirement Accounts Mint

All About Msme Loans Under 59 Minutes In India Eztax In Tax Software Accounting Accounting Software

Home Legal Services Legal Advice Legal

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

मयचअल फड सकमस न लकडउन म भ दय 25 फसद क रटरन नवशक हए मलमल Investing Compass App Money Control